Checking Out the Benefits and Dangers of Investing in Cryptocurrencies

The landscape of copyright investment is identified by an intricate interplay of compelling advantages and substantial dangers. As we additionally analyze the nuances of copyright financial investment, it becomes obvious that informed decision-making is paramount; however, the concern remains: Just how can investors effectively balance these benefits and risks to secure their financial futures?

Recognizing copyright Essentials

As the electronic landscape progresses, understanding the fundamentals of copyright comes to be crucial for potential capitalists. copyright is a kind of electronic or digital currency that utilizes cryptography for safety, making it difficult to imitation or double-spend. The decentralized nature of cryptocurrencies, normally built on blockchain modern technology, enhances their safety and security and transparency, as deals are recorded throughout a distributed ledger.

Bitcoin, created in 2009, is the very first and most widely known copyright, but thousands of alternatives, called altcoins, have actually emerged given that after that, each with unique attributes and objectives. Financiers must acquaint themselves with key concepts, including budgets, which keep exclusive and public tricks essential for transactions, and exchanges, where cryptocurrencies can be gotten, marketed, or traded.

Furthermore, recognizing the volatility related to copyright markets is vital, as costs can rise and fall substantially within short periods. Regulatory considerations also play a significant duty, as various countries have differing stances on copyright, affecting its usage and approval. By understanding these fundamental aspects, possible financiers can make enlightened choices as they browse the intricate world of cryptocurrencies.

Secret Benefits of copyright Investment

Investing in cryptocurrencies supplies several compelling benefits that can draw in both newbie and experienced capitalists alike. Among the main benefits is the capacity for substantial returns. Historically, cryptocurrencies have actually shown exceptional price appreciation, with very early adopters of assets like Bitcoin and Ethereum understanding considerable gains.

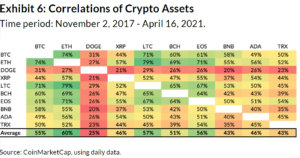

One more trick advantage is the diversity chance that cryptocurrencies give. As a non-correlated possession class, cryptocurrencies can work as a hedge against typical market volatility, enabling financiers to spread their risks across numerous investment lorries. This diversification can improve overall profile efficiency.

Moreover, the decentralized nature of cryptocurrencies provides a level of autonomy and control over one's properties that is usually doing not have in standard finance. Investors can manage their holdings without intermediaries, possibly decreasing costs and raising transparency.

In addition, the expanding approval of cryptocurrencies in mainstream finance and business additionally solidifies their worth recommendation. Numerous businesses currently accept copyright payments, leading the way for more comprehensive fostering.

Lastly, the technical development underlying cryptocurrencies, such as blockchain, presents possibilities for investment in arising industries, consisting of decentralized financing (DeFi) and non-fungible symbols (NFTs), enhancing the financial investment landscape.

Major Threats to Think About

One more essential danger is governing uncertainty. Governments worldwide are still formulating plans pertaining to cryptocurrencies, and modifications in guidelines can significantly affect market characteristics - order cryptocurrencies. An unfavorable regulative setting could restrict trading and even bring about the banning of specific cryptocurrencies

Protection risks also present a substantial threat. Unlike conventional monetary systems, cryptocurrencies are prone to hacking and fraudulence. Investor losses can occur if exchanges are hacked or if personal secrets are endangered.

Last but not least, the absence of important site customer protections in the copyright space can leave investors susceptible - order cryptocurrencies. With restricted option in case of scams or burglary, people might discover it testing to recoup shed funds

Taking into account these threats, thorough research and risk assessment are essential before engaging in copyright investments.

Techniques for Successful Investing

Creating a robust strategy is essential for browsing the complexities of copyright investment. Capitalists must begin by performing detailed research study to understand the underlying modern technologies and market characteristics of various cryptocurrencies. This consists of staying educated regarding trends, governing advancements, and market view, which can substantially influence property performance.

Diversity is an additional crucial method. By spreading out financial investments throughout several cryptocurrencies, investors can reduce threats connected with volatility in any solitary property. A well-balanced profile can offer a barrier versus market click for info changes while boosting the capacity for returns.

Establishing clear investment objectives is essential - order cryptocurrencies. Whether intending for short-term gains or long-lasting wide range accumulation, specifying specific goals aids in making informed decisions. Applying stop-loss orders can also secure financial investments from significant slumps, enabling a regimented leave strategy

Lastly, constant surveillance and reassessment of the investment method is essential. The copyright landscape is vibrant, and frequently reviewing performance versus market problems makes certain that investors stay active and receptive. By sticking to these approaches, investors can enhance their possibilities of success in the ever-evolving world of copyright.

Future Trends in copyright

As investors refine their approaches, recognizing future patterns in copyright ends up being increasingly important. The landscape of electronic money is developing rapidly, affected by technological developments, regulatory growths, and moving market dynamics.

An additional emerging trend is the expanding institutional rate of interest in cryptocurrencies. As companies and banks adopt electronic currencies, mainstream acceptance is most likely to enhance, possibly causing greater rate stability and liquidity. Additionally, the assimilation of go to website blockchain innovation into different industries mean a future where cryptocurrencies function as a backbone for deals across fields.

Improvements in scalability and energy-efficient agreement devices will certainly address issues surrounding deal rate and ecological influence, making cryptocurrencies extra viable for everyday use. Understanding these trends will be important for financiers looking to browse the intricacies of the copyright market successfully.

Verdict